Vehicle insurance does go down at 25. By contrast, motorists pay an average of $7,179 at 18 and $4,453 at 21 which shows that car insurance coverage does go down as you age.

Our analysis found that prices drop much more at other 1 year periods. Check out on to read more information about when cars and truck insurance policy does decrease. When does vehicle insurance get more affordable for young vehicle drivers? Supplied they maintain a tidy record, young motorists will likely see their cars and truck insurance decrease after every year driving when traveling yet just how much it in fact lowers by varies from year to year.

What age does vehicle insurance coverage go down for male vs women drivers? Your cars and truck insurance policy does drop after you turn 25, yet not as high as it does on other birthday celebrations - liability. Unless you live in a state where insurance companies can't factor gender right into insurance policy rates, one considerable modification happen at age 25: the distinction between what male as well https://auto-insurance-loop-chicago-il.us-east-1.linodeobjects.com/index.html as women vehicle drivers pay for automobile insurance.

car insured cheapest auto insurance affordable perks

car insured cheapest auto insurance affordable perks

Does vehicle insurance from significant national insurance firms drop at 25? We evaluated quotes from 4 of the largest auto insurance policy companies Geico, State Farm, USAA as well as Progressive and also located that while cars and truck insurance coverage does decrease at 25 with each of them, the quantity it decreases by differs significantly.

Some Known Facts About At What Age Does Car Insurance Go Down? Read On To Find Out.

Unless you live in among minority states that have actually made it unlawful, a lower credit rating might enhance your car insurance premiums (cheap car). If you transfer to a community with higher prices of burglary as well as criminal damage, after that insurers will certainly bill you higher premiums to make up the increased risk of damages or theft.

Every insurance firm computes prices in a different way, and also some insurer will emphasize different variables much more heavily than others. We advise reassessing your insurer annually to get the ideal price. How to obtain less costly automobile insurance coverage as a 25-year-old chauffeur If you're a young motorist in your 20s, you've likely wondered just how to lower your car insurance policy expenses.

vehicle insurance money business insurance suvs

vehicle insurance money business insurance suvs

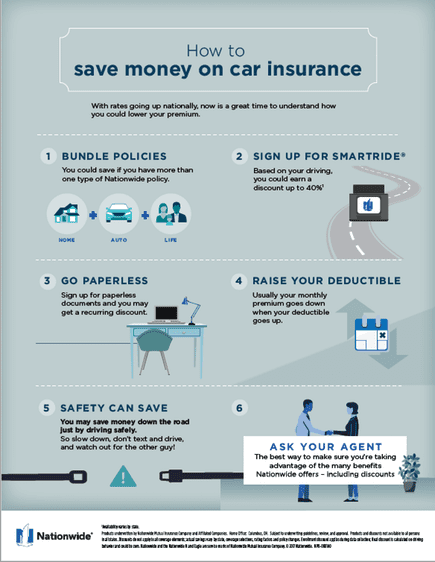

Approaches for how to make your auto insurance drop By the time you struck age 25, you have actually likely passed the factor where you can remain on your moms and dads' insurance policy. (If you have not, nevertheless, you must certainly do so, because this is just one of the very best means for young vehicle drivers to save money on their premiums.) Luckily, there are other methods for 25-year-olds to obtain their insurance policy prices to decrease.

auto insurance automobile car vehicle

auto insurance automobile car vehicle

As your cars and truck's value decreases gradually, nonetheless, consider lowering or removing crash as well as thorough coverage. If your automobile is only worth a couple of thousand dollars, it doesn't make good sense to spend for high costs to cover an asset of restricted value. If you're married and also each of you drives separate autos, you might be able to decrease your automobile insurance policy settlement by, as insurance firms consider couples more solvent and risk-averse.

The Buzz on At What Age Does Car Insurance Go Down? Read On To Find Out

Discount rates for 25-year-old vehicle drivers As you shop around for the finest rate, see to it you're additionally asking insurer concerning all appropriate price cuts. Twenty-five-year-old motorists may not be able to capitalize on student-away-from-home or good-student plans, however there are lots of various other means these young chauffeurs can save on cars and truck insurance: You could not be able to get approved for a good-student discount rate anymore, however your college might have partnered with an insurance policy company to safeguard discounts for alumni.

By taking a, you'll not only learn how to drive more safely, yet you can lower your car insurance coverage premium anywhere from 5% to 20%. Be recommended, nonetheless, that some states and also some insurance providers only expand this price cut to seniors or vehicle drivers under 25. Talk to your insurance policy firm to see if you qualify prior to you enroll in a course.

Does your auto have certain safety and security features, such as anti-lock brakes or daytime running lights? You might get a car price cut due to it. Inquire about these discounts when you call insurance coverage firms for a quote (insurance). You might be amazed at the financial savings you're able to generate simply by asking inquiries.

When you first obtain your license as a teen, there's a great chance you're not spending for vehicle insurance policy on your own, which is fortunate, because those very first few years of being guaranteed are some of the most expensive of your entire life. But excellent points involve those that wait, and that's also true for the price of car insurance, which decreases when you age.

The 5-Minute Rule for 5 Ways To Keep Your Car Insurance Costs Down - Consumer ...

car insured insurance companies vehicle insurance car insurance

car insured insurance companies vehicle insurance car insurance

vehicle insurance trucks insurance company cheap insurance

vehicle insurance trucks insurance company cheap insurance

As well as while your credit report, marital status, and education and learning level can help insurance providers gauge your degree of risk, age is just one of the biggest aspects. Teenage motorists have a tendency to create even more mishaps than older, a lot more seasoned motorists, so insurer raise your rates as a result of the high danger factor. Nevertheless, there are points you can do to assist lower your prices. insured car.

According to the Insurance Policy Institute for Freeway Safety And Security, 60 to 64 years of age have the least expensive rate of cases they're relatively great vehicle drivers with a low crash price so their insurance policy premiums are low - dui. Insurance claims rates begin going up again for 65 year olds, and deadly auto accident prices raise at 70, so those drivers typically will have greater costs.

Ask your insurer regarding: Excellent trainee discount rates, Excellent vehicle driver discounts, Automobile safety and security discount rates, Packing as well as policy renewal discounts, Usage based discounts, that track your driving with an application and also award cost savings for safe driving patterns One of the quickest methods to conserve can be to purchase new cars and truck insurance quotes from different companies (credit).

Frequently Asked Inquiries, Why does car insurance policy drop at 25? Vehicle insurance coverage business make use of statistical data, to name a few variables, when figuring out auto insurance prices. Since chauffeurs under 25 are most likely to obtain into auto crashes as well as documents claims than chauffeurs over the age of 25, younger chauffeurs pay even more.

All about Does Car Insurance Go Down At 25? - Policy Advice

Most insurance providers award secure motorists with discount rates on their premiums. Vehicle insurance coverage rates can likewise go up at renewal, also if you're gone the entire plan term without any mishaps or insurance claims - cheap auto insurance.

Being unskilled behind the wheel normally causes greater insurance rates, yet some firms still offer fantastic prices - auto. Just like for any type of various other chauffeur, discovering the ideal cars and truck insurance for brand-new motorists suggests studying as well as contrasting prices from numerous suppliers. This overview will certainly provide an introduction of what new motorists can expect when spending for car insurance coverage, who qualifies as a new vehicle driver and what elements shape the cost of an insurance coverage.

We recommend contrasting multiple firms to locate the finest rates. Who is considered a new chauffeur? Each state sets its very own minimal automobile insurance policy requirements, as well as car insurance coverage for new drivers will look the like any other chauffeur's policy. While a lack of driving experience doesn't transform just how much insurance policy you need, it will certainly affect the price.

As mentioned, age is just one of the main variables insurer consider when calculating costs. Part of the factor insurer hike prices for younger vehicle drivers is the raised chance of a crash. Auto accident are the second-highest leading cause of fatality for teenagers in the U.S., according to the Centers for Illness Control and also Avoidance.

The Ultimate Guide To How To Save On Your Teen's Auto Insurance - Cbs News

Adding a young motorist to an insurance coverage policy will certainly still boost your premiums substantially, however the quantity will certainly rely on your insurance coverage business, the automobile and also where you live. cheaper cars. Teens aren't the only ones driving for the very first time. A person of any age who has stayed in a huge city and mainly relied upon public transport or that hasn't had the means to acquire an automobile could likewise be taken into consideration a brand-new motorist.

Despite the fact that you might not have experience when traveling, if you're over 25, you may see lower rates than a teen motorist. credit. One more thing to take into consideration is that if you live in a location that has public transportation or you do not intend on driving much, there are alternatives to typical insurance, like usage-based insurance.

Immigrants and also international nationals can be identified as brand-new chauffeurs when they initially go into the united state - auto insurance. This is because car insurance coverage firms normally examine domestic driving records, so you can have a clean driving document in an additional country as well as still be taken into consideration an inexperienced chauffeur after relocating to the States.

We advise using the complying with strategies if you're acquiring car insurance policy for new drivers. Contrast firms No 2 insurance policy firms will certainly provide you the exact same cost.

Our When Does Car Insurance Go Down? - The Hartford PDFs

Our suggestions for cars and truck insurance coverage for new motorists Whether you're a brand-new chauffeur or have been driving for years, researching as well as contrasting quotes from several providers is a terrific method to locate the very best rate. Our insurance coverage experts have actually found that Geico as well as State Farm are superb choices for car insurance coverage for brand-new vehicle drivers. low-cost auto insurance.

The end outcome was an overall ranking for every carrier, with the insurers that scored one of the most points topping the listing. In this short article, we picked firms with high general rankings as well as expense ratings, along with those with programs targeting new as well as first-time chauffeurs (insurance companies). The expense rankings were informed by car insurance coverage price quotes produced by Quadrant Details Solutions as well as discount rate opportunities.

It's restricted to three years in Virginia and isn't readily available in all states. The premium might transform if the plan and its coverages are altered. Right here are some automobile insurance discount rates and also client motivations that might use to you or others in your family: Multi-policy Discounts, If you insure several automobiles or have several authorities with ERIE (life insurance coverage or residence plan plus auto insurance policy), discounts can use.

1First Accident Mercy, Everybody is entitled to a second opportunity? Well, ERIE offers First Mishap Forgiveness, indicating you will not be surcharged the first time you're at mistake in an accident after you've been an ERIE client for 3 or even more years. Examine right into ERIE's Diminishing Deductible alternative, available in the ERIE Vehicle And Also Recommendation.

The Greatest Guide To What Age Does Car Insurance Rates Go Down? (2022)

Qualification differs by state, so make certain you qualify by consulting your representative. Automobile Storage, Perhaps you desire to keep your cars and truck out of the negative winter months climate, or maybe you're flying to a warmer destination for a while. Whatever the reason, if you prepare to store your lorry for 90 consecutive days or even more, ERIE supplies a decreased use discount in the majority of states. cheaper.

It stands to reason that the safety functions in your automobile will certainly pay off in the form of price cuts. Factory-installed airbags, anti-theft devices and also anti-lock brakes are a few of the security features that will certainly settle for you in more means than one. Settlement Benefits, Paying for your automobile insurance policy in installations can be practical as well as valuable for the spending plan conscious. trucks.

And also after that there's the expense of including one more motorist to the plan. ERIE offers a number of discounts that could apply to your family if you have brand-new vehicle drivers.

ERIE provides to $75 per traveler in the car for travel expenses if you don't reach your destination and aren't near to house. That will absolutely assist with your supper as well as hotel area. Your precious family members pet dog may be traveling with you, as well as ERIE cares concerning your canines and pet cats.