credit insurance company auto insurance

credit insurance company auto insurance

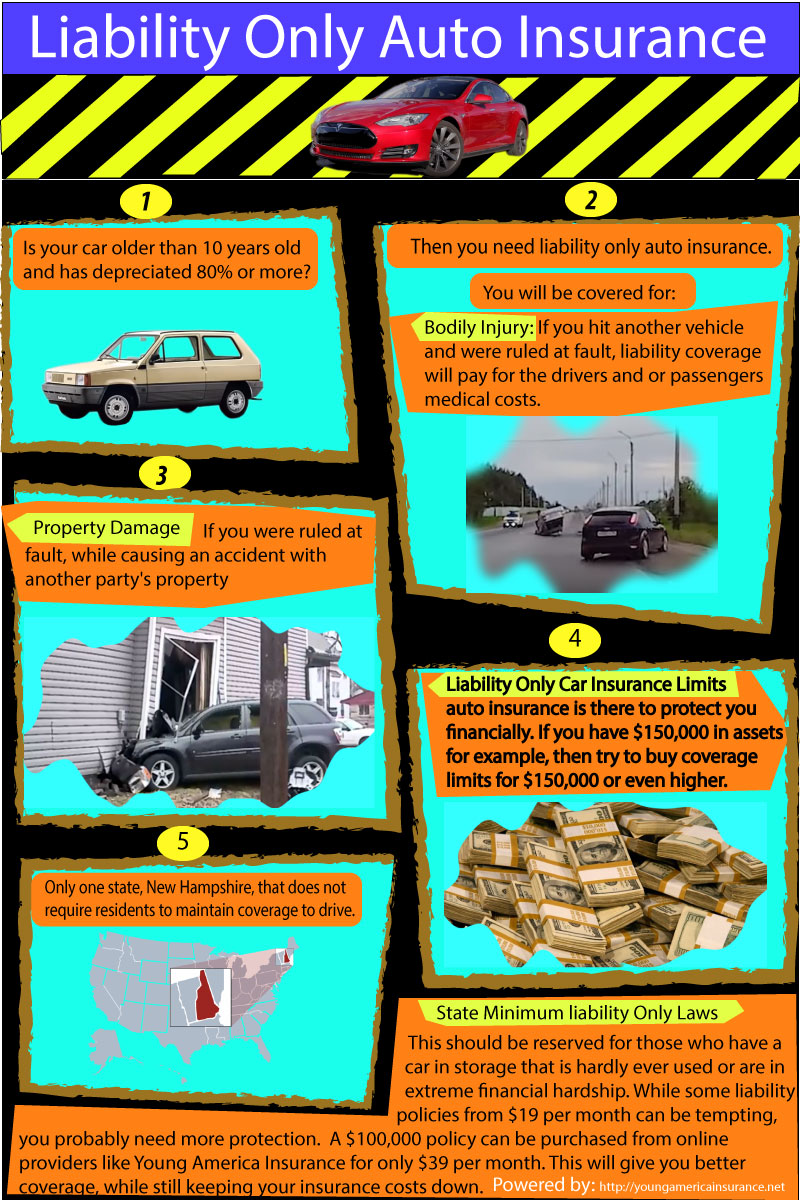

As an example, in some states, vehicle drivers are needed to acquire a minimum of $25,000 per person and $50,000 per crash in bodily injury liability as well as a minimum of $10,000 in property damages responsibility security. If a chauffeur got the minimal insurance coverage needed, the insurer would pay $25,000 per damaged target up to an optimum total amount of $50,000 for a single accident.

The minimums are normally a relatively reduced quantity of insurance coverage that can leave motorists without much security in the occasion of a significant crash. Since the coverage limitations can be exceeded extremely promptly, drivers should seriously consider buying more vehicle crash obligation insurance than the minimum amount their states need.

If a driver wants to be protected versus losses to his very own vehicle after triggering a collision, the vehicle driver will certainly require to get accident protection. For defense versus burglary or various other sorts of damages, such as hailstorm damage or criminal damage to an automobile, the chauffeur would need to acquire thorough insurance coverage (automobile).

While none of these optional protections may be mandated by legislation, unlike car crash liability insurance policy, a vehicle driver who goes without them might be at threat of significant monetary loss if something goes wrong. Chauffeurs need to recognize the limitations of auto mishap responsibility insurance policy as well as should make certain they carefully assess all of their coverage options to get the full protections in area that they require when driving their cars and trucks.

While there are several aspects that drive individuals to aim to change car insurance service providers, it is necessary to inform on your own in order to ensure you choose the ideal protection for you. vehicle insurance. The best protection means not spending for insurance coverage you don't need and not foregoing insurance coverage that would certainly make sense for your personal circumstance.

Ask people you understand and regard for their recommendations. Look for a qualified insurance coverage representative (insurance policy producer) who is reliable as well as useful in addressing your concerns. cheapest. You can seek out a representative's permit condition at NAIC - State Based Solution (SBS). You should look around for the very best insurance coverage item at the most effective rate.

Fascination About Mandatory Insurance Brochure - Illinois Secretary Of State

Pays for a new vehicle if the cost to fix your vehicle is even more than the value of a brand-new auto. The recommendation is usually offered only during the very first 3 design years. Pays a specific quantity each day (e. g (cheapest car). $15) to rent out a lorry while your own is being fixed due to a covered loss.

The more insurance policy you purchase, the higher the costs will be. Vehicle drivers with accidents and tickets usually pay higher costs than those with good driving documents.

For automobiles ran much less than a provided number of miles per year, usually 7,500. Offered when the very same business insures even more than one car in your home.

The type as well as quantity of discounts offered might vary by company (insure). Some discounts influence a part of your insurance coverage; other discount rates might influence the whole premium. If you raise your deductible, you might have the ability to substantially lower the price of insurance coverage; however you will certainly pay more out of pocket each time you have an insurance claim.

If the insurance policy agent estimates the costs incorrectly, the correct amount figured by the insurance provider is the price you will really be called for to pay - cheap insurance. Therefore, prior to you switch business, ask the representative to submit a application for you. With a application, there is no coverage and also you pay.

vehicle insurance vehicle car automobile

vehicle insurance vehicle car automobile

You have to not owe an impressive premium for previous insurance policy protection throughout the past 36 months. Your lorry has to be secure to drive.

Some Ideas on What Is Liability Insurance And What Does It Cover? - Jerry You Should Know

prices accident affordable cheaper car

prices accident affordable cheaper car

When requesting for rate quotes, it is crucial that you offer the exact same details to each agent or company. cheap. The agent will usually request the adhering to info: description of your vehicle, its use, your vehicle driver's certificate number, the variety of vehicle drivers in your household, as well as the insurance coverages as well as restrictions you desire.

You will be asked to respond to several questions regarding yourself, where you live, your desired degree of protection, as well as your auto or residence. Addressing these inquiries to the very best of your capacity ought to result in a much better price quote. Where to Store, Inspect online, the newspaper as well as yellow web pages of the phone book for business as well as agents in your area.

In particular, ask them what kind of insurance claim solution they have actually received from the firms they recommend. For Your Security, Once you have chosen the insurance policy coverages you require and also an insurance coverage agent or business, there are actions you can take to make particular you obtain your money's well worth.

It is unlawful for unlicensed insurance firms to market insurance and, if you purchase from an unlicensed insurance provider, you have no assurance that the insurance coverage you pay for will ever be recognized. Review Your Policy Very Carefully, You ought to be aware that a vehicle insurance coverage plan is a lawful agreement. It is composed so your civil liberties as well as responsibilities, in addition to those of the insurance coverage business, are clearly specified.

You should read that policy and ensure you comprehend its components - insurers. If you have concerns about your insurance coverage, contact your insurance coverage agent for explanation.

which covers your legal obligation for damages to the home of others triggered by accident with your car. In an accident, the "home of others" is usually one more cars and truck, but it additionally covers damage to public and exclusive building such as road indicators, bridges or structures, up to the limitations written into the plan. car insured.

Not known Facts About Car Insurance - Farm Bureau Financial Services

which covers your bodily injuries and those of your guests if you are struck by a without insurance vehicle driver or hit-and-run vehicle driver who is responsible for the mishap. It does not cover damages to your vehicle. A minimum obligation insurance package could be revealed as 25/50/25, BI, PD, and 25/50 UM.

The numbers represent: $25,000 is the optimum physical injury responsibility settlement under the plan for injury (or fatalities) to one individual associated with a single mishap. $50,000 is the maximum bodily injury responsibility repayment that can be created injuries (or fatality) to all individuals included in a solitary mishap.

$25,000 is the maximum uninsured vehicle driver settlement that can be made to someone associated with a single accident. $50,000 is the optimum uninsured vehicle driver settlement that can be made to all persons associated with a single accident. Individuals harmed as a result of your driving can and also typically do file a claim against for damages greater than this example.

It is feasible to buy even more coverage defense than the minimal degree of insurance coverage called for. Obligation insurance policy coverage safeguards you only if you are accountable for a mishap and also pays for the injuries to others or problems to their residential property.

What other sorts of insurance coverage can I purchase? Drivers that wish to secure their cars versus physical damages can need to acquire: This protection is for damage to your vehicle arising from an accident, no matter who is at fault. It offers fixing of the damage to your automobile or a financial settlement to compensate you for your loss (affordable).

What Is Liability Insurance? - Progressive Can Be Fun For Anyone

It also pays for treating injuries resulting from being struck as a pedestrian by a motor automobile. Your auto insurance deductible is the quantity of money you need to pay out-of-pocket before your insurance compensates you.

You have a Subaru Outback that has Accident Protection with a $1,000 insurance deductible. In this scenario, you would pay the body store $1,000.

When you have fulfilled your $1,000 deductible the insurance policy business will pay the staying $5,500. Just how does my deductible influence the expense of my insurance?

How do I purchase automobile insurance? When acquiring insurance, the Department of Insurance advises that you seek the recommendations of a competent insurance policy specialist. There are 3 types of specialists that usually offer insurance coverage: Independent agents: can sell insurance from several unaffiliated insurers. Exclusive agents: can just sell insurance coverage from the firm or team of business with which they are connected - credit.

No matter what kind of specialist you select to use, it is necessary to confirm that they are accredited to perform service in the State of Nevada. You can examine the certificate of an insurance policy expert or business below. Bear in mind Constantly verify that an insurance business or representative are licensed before providing them individual information or repayment.

car insurance cheaper auto insurance vehicle vehicle insurance

car insurance cheaper auto insurance vehicle vehicle insurance

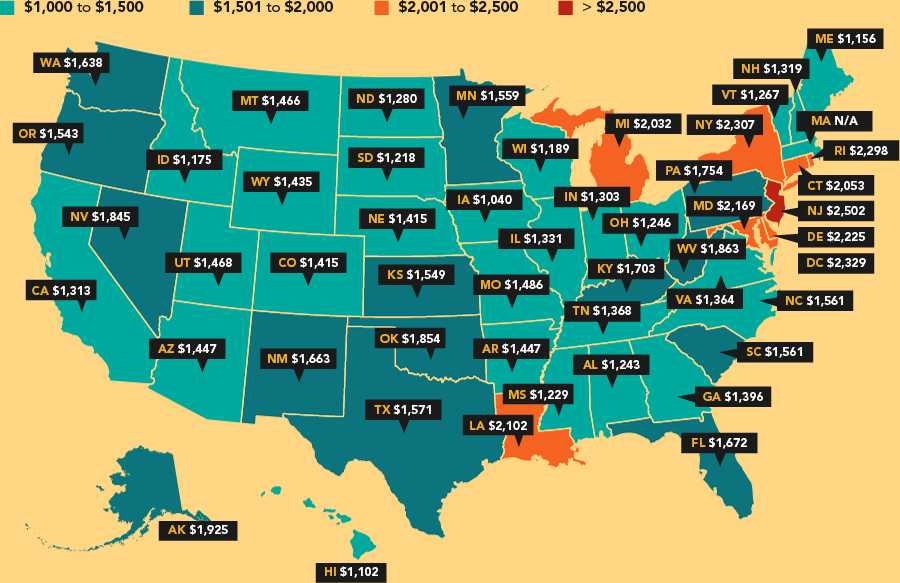

These aspects consist of, but are not limited to: Driving record Insurance claims history Where you live Sex as well as age Marriage Condition Make as well as model of your automobile Credit rating Nevada has one of one of the most competitive and also healthy vehicle insurance coverage markets in the nation. Looking for insurance policy might allow you to achieve competitive rates. insured car.

7 Easy Facts About Liability Insurance Coverage - Bankrate Shown

To learn more about making use of your credit info by insurance provider read our Frequently Asked Questions Concerning Credit-Based Insurance Ratings.

Are there ways to conserve money as well as still have the appropriate amount of protection? Below we information 5 types of protections and provide a couple of scenarios where you would certainly profit from having a non-required coverage included to your policy along with some suggestions to save some cash depending on your automobile as well as Learn more budget plan (cheap insurance).

Responsibility insurance will cover the expense of fixing any type of property damaged by a mishap in addition to the clinical bills from resulting injuries. Many states have a minimum demand for the amount of responsibility insurance protection that motorists need to have. If you can manage it, nonetheless, it is typically an excellent concept to have liability insurance that is over your state's minimum responsibility protection need, as it will give extra security in case you are located to blame for a crash, as you are accountable for any type of claims that surpass your insurance coverage's ceiling.

If there is a protected crash, crash insurance coverage will certainly pay for the fixings to your automobile. If your auto is amounted to (where the expense to repair it surpasses the worth of the lorry) in a mishap, collision coverage will certainly pay the worth of your auto. cars. If your vehicle is older, it might not deserve carrying accident insurance coverage on it, depending upon the worth.

Note: If you have a lienholder, this coverage is required (laws). What happens if something takes place to your automobile that is unrelated to a covered mishap - weather condition damage, you struck a deer, your auto is stolen - will your insurance provider cover the loss? Obligation insurance coverage as well as accident coverage cover accidents, but not these circumstances.

Comprehensive insurance coverage is just one of those things that is great to have if it fits in your budget - low cost auto. Anti-theft and also monitoring devices on vehicles can make this insurance coverage somewhat much more economical, but bring this kind of insurance coverage can be pricey, as well as might not be needed, specifically if your auto is conveniently exchangeable.