Our leading five picks for the ideal auto insurance coverage are USAA, Geico, State Farm, Progressive as well as Travelers. # USAA: Low Prices for Military Average cost: $Number of discounts: 12Usage-based insurance: Safe, Pilot, TM in 37 states USAA is our very first option for the finest vehicle insurance in the country. It uses the cheapest car insurance policy on average compared to any type of other carrier we investigated.

Pertaining to price, Geico's rates are some of the most inexpensive we have actually seen. Our price quotes show that motorists pay about usually for full insurance coverage car insurance policy from Geico. These rate estimates use to 35-year-olds with great debt and driving records. trucks. Our price quotes place Geico in the top three business for affordability contrasted to other national carriers.

Past the typical sorts of insurance coverage, State Ranch supplies: Emergency road solution coverage Car service and also travel expenses insurance coverage Rideshare driver protection Our price price quotes show excellent chauffeurs pay an average of about for complete insurance coverage insurance policy with State Ranch. This rates State Ranch amongst one of the most budget-friendly nationwide suppliers - low cost.

According to the NAIC, State Ranch represented 15. 93% of the vehicle insurance policy market share in 2021. State Farm also had less complaints than the market average in 2020, though client evaluations on the BBB are combined. We picked State Farm as one of the nation's finest auto insurer in component due to the usage-based and safe driving discounts it offers to young chauffeurs.

Our 2022 cars and truck insurance study located 74% of Progressive policyholders are pleased with their coverage. The company also composed even more than $35 billion in premiums in 2021, according to the NAIC - car insurance.

Not known Details About Ally: Banking, Investing, Home Loans & Auto Finance

In the J.D. Power Auto Insurance Study, Travelers racked up below the sector standard in almost every region except New York. Our team got to out to Travelers for a discuss its negative testimonial scores but did not receive a feedback. According to our study, Travelers insurance rates is a little less costly than the national standard, setting you back $1,617 per year on average for a full protection plan.

You can figure out much more in our complete Travelers insurance testimonial.

cars insurance cheap car

cars insurance cheap car

Power overall cases complete satisfaction rating: N/An Alternating best auto insurance provider for young chauffeurs: State Farm If you're a young vehicle driver, after that you may not desire an insurance company tracking your driving routines. In that case, you must seek an insurance firm that tends to have reduced rates for young drivers (insurance).

However, they will not all penalize you to the exact same degree. Farm Bureau elevates rates by 34% when chauffeurs have an at-fault mishap in their current background 6% much less than average. Using rates pulled from around the nation, we located that Farm Bureau only raises prices by $534 annually for a full insurance coverage policy after a crash.

All written material on this website is for details functions only. Opinions shared herein are entirely those of AWM, unless otherwise particularly mentioned. Material provided is thought to be from trusted resources and no depictions are made by our firm regarding one more celebrations' informative accuracy or completeness. All information or suggestions given should be talked about in information with an advisor, accountant or lawful advise prior to application.

Unless or else shown, the use of 3rd party hallmarks here does not suggest or show any type of connection, sponsorship, or recommendation between Good Monetary Cents as well as the owners of those trademarks. Any kind of recommendation in this internet site to 3rd celebration trademarks is to determine the matching third party goods and/or services - trucks.

Cheap Car Insurance - Affordable Auto Insurance - Liberty Mutual Fundamentals Explained

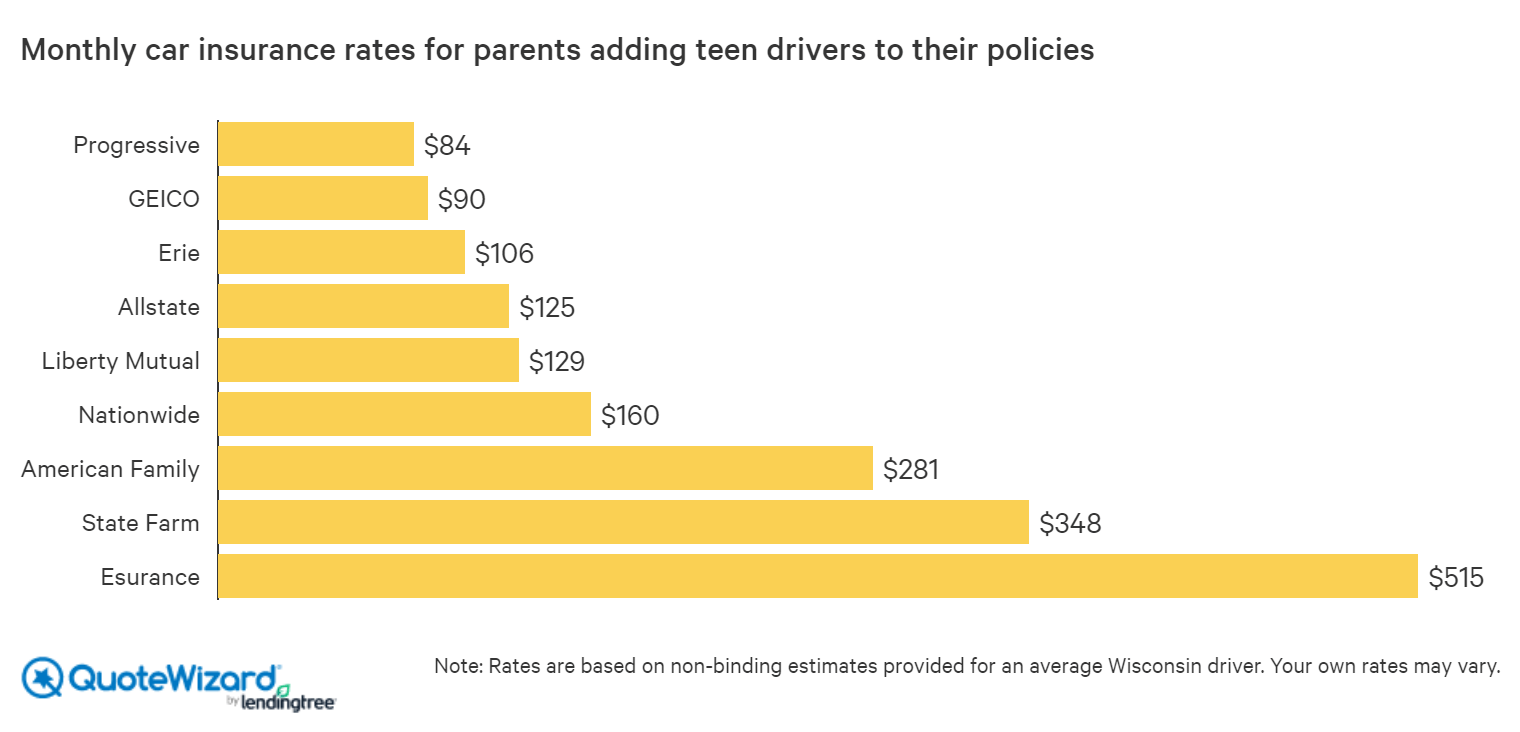

Final Verdict Cars and truck insurance for teens and also university student can be costly, and perhaps perplexing to buy. Fortunately is that numerous insurance coverage business offer price cuts and other means to aid youths save while getting the coverage they require. Offering a compelling total package of rate, possibilities to conserve, alleviate of usage, and also financial security, State Farm is our option for the very best general auto insurance policy for teens and college students - low-cost auto insurance.

car auto cheaper car insurance auto

car auto cheaper car insurance auto

In many cases, moms and dads might think that they restrict their responsibility if their youngster has their own plan, however insurance policy professionals recommend this may not be the case (cheapest). Contrasting Automobile Insurance for Teens as well as University student When purchasing for vehicle insurance for teenagers as well as university student, take into consideration the list below factors:: Insuring a teen or university student can be costly, yet prices differ among business.

These often consist of price cuts for having at the very least a B standard in institution, for completing driver training, or for being away at college full time.: Responsibility insurance coverage is necessary in the majority of states, while thorough, crash, and void protection may be needed by the bank for a vehicle with a finance or lease. cheaper auto insurance.

Exactly How Teens and also University Student Can Get Automobile Insurance Protection There are multiple methods for a teen or university student to acquire vehicle insurance coverage.: An agent can offer individual solution as well as suggestions customized to the insurance policy requires of teens and also university trainees. Independent agents represent multiple companies as well as can go shopping around on their customer's behalf to discover the very best mix of insurance coverage, cost, as well as price cuts.

While this alternative is available 24/7, a disadvantage is that it gives little to no support on protections and discounts.: Still an additional choice is for teenagers and also university student to call an insurer directly by phone (cheaper cars). Many have toll-free numbers linking to firm reps who can assist with the plan quote as well as acquisition.

Exactly How Much Does Auto Insurance Policy for Teenagers as well as University Students Price? Vehicle insurance policy for teens as well as university students is commonly fairly costly.

Not known Facts About Best Car Insurance Companies In Pennsylvania - Cars.com

What Does Cars And Truck Insurance for Teenagers and also University Student Cover? An auto insurance coverage policy for teenagers and also university students ought to consist of the complying with essential insurance coverages:: This offers coverage if the motorist causes a crash that hurts another individual or damages their home. trucks. Obligation is mandatory in a lot of states.: This provides protection if the chauffeur remains in a mishap with somebody that is not insured.

money cheap cars insurance companies

money cheap cars insurance companies

Vehicle insurance policy will not cover the cost of maintenance or fixings connected to use and tear. An insurance firm may, nevertheless, provide optional roadside help coverage, which can help a driver in an emergency situation such as having a flat tire or dead battery. That Can Acquisition Vehicle Insurance Policy for Teens and University Student? Auto insurance for teenagers and college students can be acquired by many accredited motorists.

Several of the business in our study required a motorist to be 18 to purchase insurance read more coverage, others required a chauffeur to be only 16. insurance affordable. How to Get Cars And Truck Insurance for Your Teen or as a Young Motorist Asking for quotes from at least three different insurance provider is an excellent way to locate a policy that provides the most effective worth for your requirements.

These representatives are acquainted with several insurance companies, including smaller, local choices, and also they may be able to make recommendations as well as help you compare coverages so you can pick a policy that's the very best suitable for you as a young chauffeur (insure). Keep in mind to state any kind of variables that may help you qualify for discount rates, like whether you have actually taken chauffeur training, if you're intending to participate in college away from house, as well as if your qualities are excellent.

, may supply mishap mercy that prevents a mishap from increasing your prices. USAA, GEICO and also State Farm may provide the lowest rates if you haven't been in a mishap or have been in one at-fault mishap - low cost auto.

Best Vehicle Insurance Rates for Young Chauffeurs, As anyone who's included a teenager to their automobile insurance coverage can tell you, young chauffeurs have a tendency to be expensive to insure. Rates drop as you age, as well as can level out when a vehicle driver is in their mid-20s. If you're a young adult (or somebody covered by your plan is), you might desire to go shopping for brand-new quotes after every birthday celebration.

The Ultimate Guide To Compare 2022 Car Insurance Rates Side-by-side - The Zebra

Among the more conventional insurance business, USAA, State Ranch as well as GEICO may supply the lowest prices. Often, there won't be a huge distinction unless you go with a usage-based policy.

At a minimum, a lot of states call for drivers to have liability insurance coverage, which pays for others' clinical costs and damage to their property. You might additionally need to buy medical protection or injury defense, which can assist spend for your (and also your passengers') treatment. If you desire insurance coverage in situation your automobile is harmed or stolen, you'll require crash insurance coverage (for damages from accidents) and comprehensive insurance coverage (for theft and damage caused by something besides a collision, such as a tornado).

It's a tradeoff as even more protection and also reduced deductibles additionally lead to greater costs. How to Get the very best Rates on Your Car Insurance No matter which kinds of insurance coverage, restrictions as well as deductibles you choose, there are a couple of means to conserve money on auto insurance coverage: There's no insurance coverage firm that uses the very best cost for every person.

You will not constantly find a cost savings possibility, but the elements that determine your rates, your insurance policy needs and also the companies' offering and choices can all change gradually.

Corpus Christi, TX "If you're requiring insurance policy - insured car. Haven't had insurance for a while, then Straight is where you require to go." E&E Wilburn Nashville, TN.

That's why it's essential to do your research study as well as compare your alternatives when choosing the most effective automobile insurance provider for your needs. As soon as you have a suggestion of what your costs may be from a few various companies, after that you can consider facets that establish particular automobile insurance coverage companies in addition to others, like vehicle coverage attachments or customer contentment rankings.

The Greatest Guide To The 7 Best Car Insurance Companies 2021 - Reviews.com

Availability, car insurance claims satisfaction, rate, and the firm's economic wellness are all crucial aspects we consider in our referrals. While no single car insurer will be the very best for every individual, we assume these are the ones to consider when in the market for car insurance policy. To determine our choices for the finest auto insurer, we started with a checklist of 25 of the largest cars and truck insurer by premiums gathered, based upon information from the National Association of Insurance Coverage Commissioners.

We dismissed any type of business that doesn't have A.M. insurance. Ideal's score of A+ or greater. We additionally removed any type of companies that are associated with any kind of energetic fraud investigations. Our Picks for the Finest Automobile Insurance Provider Business Review, GEICO GEICO, the second-largest vehicle insurer in the nation, insures almost 30 million vehicles, according to its internet site.

cheapest cheapest car insurance cheapest car

cheapest cheapest car insurance cheapest car

Vehicle Insurance Claims Complete Satisfaction Research Study. It also has the cheapest ordinary yearly premium of insurers on this listing. This affordable company does not provide the most special discounts, yet it uses lots of typical discount rates for consumers like savings for packing policies or for having even more than one cars and truck on the plan - cars.